Notion vs Finance Apps in 2026: Which Should You Use?

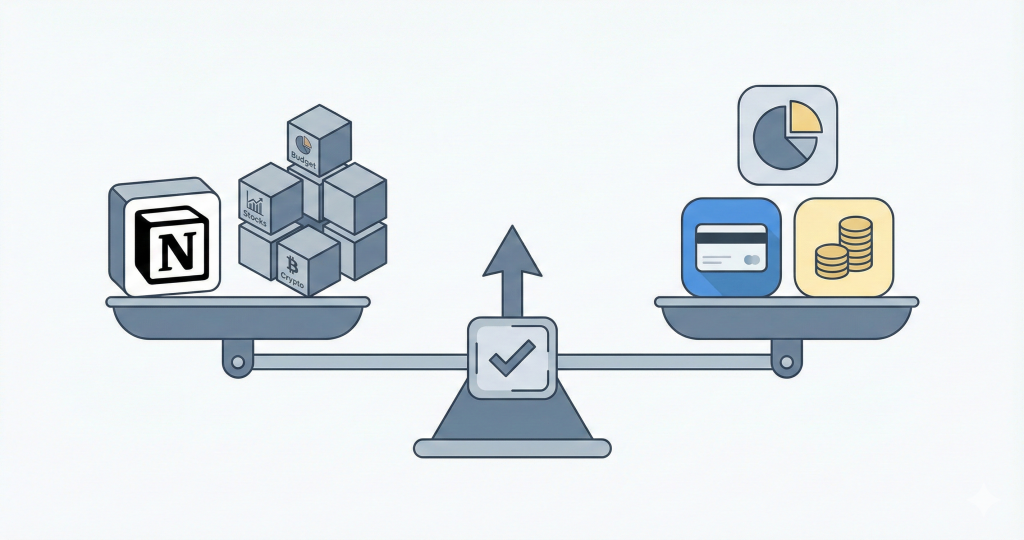

If you're deciding between a Notion-based finance system and a dedicated app, the right choice depends on what you're optimizing for.

This comparison covers the main options honestly, including where Notion falls short.

The main options in 2026

Mint is dead. It shut down in October 2023. If you're seeing old comparisons that include Mint, they're outdated.

The current landscape:

| Tool | Best for | Pricing |

|---|---|---|

| YNAB | Zero-based budgeting, debt payoff | $14.99/month ($109/year) |

| Monarch Money | All-in-one budgeting + investing | $14.99/month ($99.99/year) |

| Empower (formerly Personal Capital) | Investment tracking, retirement planning | Free (wealth management services extra) |

| Copilot (Apple devices only) | Clean UI, Apple users | $95/year |

| Rocket Money | Bill negotiation, subscription cancellation | Free basic, $6-12/month premium |

| Notion Finance Tracker | Customization, multi-currency, Notion users | $29 one-time |

Quick decision guide

| Tool | Choose it if... |

|---|---|

| YNAB | You want zero-based budgeting with educational resources. Focused on debt payoff or building savings habits. Don't mind subscriptions. |

| Monarch Money | You want bank syncing + budgeting + investments in one polished app. Coming from Mint. Want to share with a partner. |

| Rocket Money | You want help canceling subscriptions and negotiating bills. Want a free tier. Reducing recurring expenses is your main goal. |

| Empower | You're focused on investments and retirement. Want free portfolio tracking. Don't need detailed budgeting. |

| Copilot | You're on Apple devices and want a clean, modern UI. US-based accounts only. |

| Notion Finance Tracker | You already use Notion. Want full customization. Need multi-currency. Prefer one-time payment. |

The trade-offs

Bank syncing

Dedicated apps: Most sync with your bank automatically. Transactions import without manual entry.

Notion: No bank syncing. You enter transactions manually (or use the Recurring database for predictable ones). Some people prefer this—it forces awareness of spending. Others find it too much friction.

Budgeting methodology

YNAB: Opinionated. Every dollar gets a job. The app enforces the methodology.

Notion Finance Tracker: Flexible. You can do zero-based budgeting, 50/30/20, or whatever system you want. The template doesn't enforce a specific approach.

Investment tracking

| Feature | Empower | Monarch | YNAB | Notion Finance Tracker |

|---|---|---|---|---|

| Real-time stock prices | Yes | Yes | No | Yes |

| Cryptocurrency | Limited | Yes | No | Yes |

| Manual trade entry | No | Yes | No | Yes |

| Holdings breakdown | Yes | Yes | No | Yes |

| Retirement projections | Yes | Basic | No | No |

If retirement planning is your priority, Empower wins. For tracking holdings with real-time prices, Notion Finance Tracker and Monarch are comparable.

Multi-currency

Most US-focused apps handle one currency. If you earn or spend in multiple currencies:

- Empower: USD only

- YNAB: Supports multiple currencies but conversion is manual

- Monarch: USD primary, limited multi-currency

- Notion Finance Tracker: Full multi-currency with automatic conversion

For digital nomads, expats, or anyone with international finances, this is often the deciding factor.

Customization

Dedicated apps: What you see is what you get. You can rename categories, but you can't change how the system works.

Notion: You own the databases. Add properties, change views, connect to other systems, build dashboards. If you want a spending heatmap or a custom report, you can build it.

Data ownership

Dedicated apps: Your data lives on their servers. If the company shuts down (like Mint did), you need to export and migrate.

Notion: Your data lives in your Notion workspace. You control it. Export anytime. No dependency on a finance company staying in business.

Pricing over time

| Tool | Year 1 | Year 3 | Year 5 |

|---|---|---|---|

| YNAB | $109 | $327 | $545 |

| Monarch | $100 | $300 | $500 |

| Copilot | $95 | $285 | $475 |

| Rocket Money (premium) | ~$100 | ~$300 | ~$500 |

| Empower (basic) | $0 | $0 | $0 |

| Notion Finance Tracker | $29 | $0 | $0 |

One-time vs subscription adds up.

What Notion can't do

Notion is great but it's not a perfect solution. It does have some limitations for finance tracking:

- No bank syncing. Every transaction is manual entry or scheduled via Recurring.

- No credit score monitoring. Use a free service like Credit Karma separately.

- No bill pay. Notion tracks bills; it doesn't pay them.

- No mobile-first design. The Notion app works on mobile, but it's not optimized for it.

- No retirement projections. You can track investments, but there's no Monte Carlo simulation or retirement calculator.

If any of these are must-haves, a dedicated app might serve you better.

The hybrid approach

Some people use both:

- YNAB for budgeting (daily transaction entry, envelope system)

- Notion for the bigger picture (net worth, investments, financial goals alongside life goals)

Or:

- Empower for investments (free, good portfolio analysis)

- Notion for everything else (budgeting, accounts, net worth aggregation)

There's no rule that says you can only use one tool.

Making the switch

If you're moving from an app to Notion:

- Export your transaction history (most apps allow CSV export)

- Set up your accounts in Notion

- Decide how much history to import (often starting fresh is easier)

- Run both systems for 1-2 months while you build the habit

- Stop using the old app once Notion feels natural

The learning curve is real. Give yourself a few weeks before judging.

Bottom line

Choose the tool that you'll actually use.

The best finance system is one you maintain consistently. If Notion fits your workflow and you'll stick with it, it's the right choice. If you need bank syncing and the discipline of a purpose-built app, YNAB or Monarch will serve you better.

For Notion users who want everything in one workspace, with full control over the system: